October 23, 2025

10 min 50 sec read

What Is A Copay In Health Insurance? A Comprehensive Guide To Copay Benefits And How It Works

Written by: Team Achha Kiya Insurance Liya

Summary

A copay (or copayment) in health insurance is a fixed portion of medical bill that the policyholder must pay during a claim. Typically ranging between 10% to 30%, it is pre-decided by the insurer or based on the chosen plan. Copay helps lower premiums and encourages responsible use of healthcare. However, it may lead to higher out-of-pocket expenses and limited coverage. Therefore, understanding its working, benefits, and limitations is essential before opting for such a plan.

Table of Contents

- Introduction

- What Is Copay in Health Insurance?

- Copay Calculation

- When Does Copayment Come into Play?

- Deductible vs Copay: How Is Copay Different from Deductibles?

- Types of Copay Clauses in Health Insurance

- Is Copay Mandatory?

- Things to Keep in Mind Before Considering Purchasing Health Insurance With a Copay Clause

- Advantages and Disadvantages of Having a Copayment Clause in Medical Insurance

- Why Should You Buy a Health Insurance Plan With a Copay Clause?

- Conclusion

Introduction

Health Insurance is an essential investment for health. With rising health uncertainties and medical inflation, health insurance offers much needed financial security. However, the high premiums of this insurance may deter individuals from purchasing it. In these cases, policyholders can consider insurance plans with a copay. One has to take a concrete decision in this regard by comparing the amount that is likely to be deducted from the claim amount as compared to benefit given as reduction in premium.

This article will help you understand the meaning of copay in health insurance, its various types and working.

What Is Copay in Health Insurance?

Copay or copayment is a health insurance feature. Under this, the policyholder pays a fixed portion of medical expenses while the insurer covers the rest. This helps reduce the cost of premiums.

For instance, let’s say that the eligible claim amount is Rs 5 Lakhs. The total medical bill has come to Rs 5 Lakhs with a 15% copay; the insurance company will deduct 15% from the claimed amount and pay the balance as per Terms and Conditions of the Policy.

The copay amount often ranges between 10% to 30% on the medical bill. Policyholders can choose the copay percentage based on their understanding of the clauses and plan types.

Let’s understand what copay in health insurance with the help of an example is:

Copay Calculation

- Eligible Claim Amount : Rs. 5,00,000

- Copay: 15%

- Copay Amount: Rs. 5,00,000*(15%) = Rs 75,000

- Coverage Provided: Rs. 5,00,000 – Rs. 75,000 = Rs. 4,25,000

- Payable Amount: Rs 425,000- Basis Policy Terms and conditions

When Does Copayment Come into Play?

If a health insurance policy has a pre-agreed copay clause, it gets activated as soon as the claim is raised against medical bills. The policyholder is then required to pay the copay amount. Once the copay amount is paid, the insurance company pays the rest of the admissible amount.

Deductible vs Copay: How Is Copay Different from Deductibles?

While deductibles and Copay are part of health insurance, they differ in terms of payment, time and how they are applicable.

| Feature | Co-payment | Deductible |

|---|---|---|

| Meaning | Copay is a pre-decided portion of the claimed medical bill amount which should be borne by the policyholder. | Deductibles are fixed amounts that must be borne by the policyholder against the claimed medical bill amount. |

| Payment time | Deducted from the amount payable at the time of settlement of a claim or while extending cashless. | Deducted from the amount payable at the time of settlement of a claim or while extending cashless |

| Amount | Percentage of the claimed amount | Fixed amount |

| Determination | Pre-determined by the insurance company or the customer can choose from the provided options. | Decided by the policyholder or the insurer |

| Effect on premium | Reduces the premium amount | Reduces the premium amount |

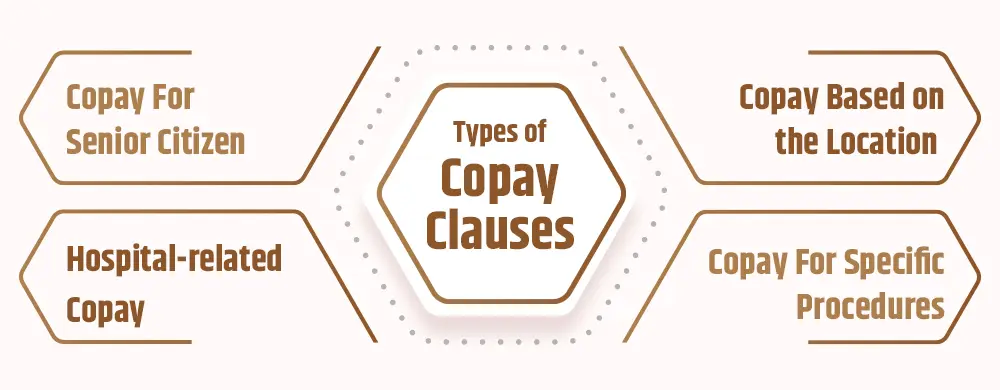

Types of Copay Clauses in Health Insurance

There are various types of copay clauses that apply to different health insurance plans. Let’s understand each one of them:

- Copay For Senior Citizen: Health insurance policies for senior citizens may include a mandatory copay clause due to higher medical expenses.

- Hospital-Related Copay: Some health insurance policies may have copay applied on claims when the treatment has been done at a non-network hospital.

- Copay Clause Based on the Location: Copay clauses also vary based on location and may be required for metro cities as taking treatment in a higher zone increases the medical expenses. This is because the medical expenses in a tier-1 city are higher than tier 2 and 3 cities.

- Copay For Specific Procedures: Some insurers also apply copay on specific treatments or procedures. This is often done for expensive treatments or pre-existing conditions.

Is Copay Mandatory?

Copays are not mandatory in all health insurance plans; however, it is a common feature. Some plans like preventive care and daycare procedures, may not require a copay. It is often applied for medical expenses that include surgeries, hospitalization costs, specialist visits and for pre-existing diseases.

Most insurers offer it as an optional element in insurance plans helping those who want lower premiums.

Things to Keep in Mind Before Considering Purchasing Health Insurance With a Copay Clause

You might be confused to choose between a health insurance plan with copay or without it. Factors like age, budget, health and copay cost should be considered before you make a decision. Some of these essential factors are:

- Your age: Copay option often benefits younger individuals who are less likely to make a claim any time soon.

- Budget: It should be opted for by those who have adequate income to pay a certain amount out-of-pocket against a medical bill.

- Health: Individuals or family members with a pre-existing health condition or a history for certain disease, should purchase a policy without copay.

- Copayment Amount: Copay percentage should be chosen only if the policyholder is comfortable with the amount.

- Your Healthcare Needs: Always evaluate the type of health care individuals may need in future. These could be diseases, surgeries or treatments that they can anticipate.

- Network Providers: Check if the health insurance plan includes a network of healthcare providers and offers lower or no co-payment for using in-network services.

- Coverage Limitations: Check the policy for any coverage limitations or exclusions for which you may not be able to raise a claim.

- Policy Terms and Conditions: Read the policy’s terms and conditions carefully—especially the copay clause, exclusions, and any limitations. This ensures that you are not caught off guard when raising a claim.

Advantages and Disadvantages of Having a Copayment Clause in Medical Insurance

Advantages of Copay

- Lower Premiums: This feature benefits those who do not frequently raise a claim.

- Encourages Responsible Healthcare Usage: This feature ensures that the policyholder uses healthcare facilities responsibly as they will have to pay a portion of the expenses.

- Predictable Healthcare Costs: A predefined copay amount or percentage helps the policyholder predict the out-of-pocket expenses.

- Incentives For Network Usage: Some insurance companies offer zero co-pay for treatments received at a network hospital.

- Customizable Premiums: A copay option allows the policyholders to customize the premium amount. The higher the copay, the lesser the premium.

Disadvantages Of Copay

- Higher Out-of-Pocket Costs: Health insurance is purchased to avoid out-of-pocket expenses. However, with a copay clause, the policyholder will have to bear a portion of expenses.

- Limited Coverage: Some insurance plans may not cover all healthcare services, making the policyholder pay the full amount.

- Complexity: The copay clause may be difficult to understand and use correctly at the time of raising a claim. Therefore, it is important to study the clause properly.

- Discourages Healthcare Utilization: A copay clause may discourage policyholders from taking essential healthcare services due to the fear of higher out-of-pocket expenses.

- Additional Administrative Burden: Copay requires additional paperwork which may make it more complex for both the policyholder and the insurer.

Why Should You Buy a Health Insurance Plan With a Copay Clause?

A health insurance policy with copay can help policyholders in many ways. These are:

- Lower Premium: By opting for a health insurance plan with a copay option, you can reduce your premium amount significantly.

- Avoids policy misuse: A copay clause can promote responsible healthcare usage and discourage the practice of raising claims for minor ailments or using the policy for non-medical reasons.

- Prevents expensive hospital treatments: This clause encourages people to take treatment in regular qualified hospitals rather than going for expensive ones.

Conclusion

FAQs

No, copay does not apply to deductibles. A deductible is a fixed amount to be paid on every claim or yearly by the policyholder before the coverage begins while, copay is a fixed percentage which the policyholder pays after raising the medical claim.

The health insurance policy documents include details about the copay, inclusions, exclusions, network hospital etc.

A copay clause reduces the premium cost as the bill amount is shared between both– the insurer and the policyholder. When a claim is raised, the policyholder pays a pre-decided portion while the insurer covers the remaining amount.

The purpose of copay in health insurance is to share the cost of medical bills between insurer and the policyholder. It helps make premiums affordable for the policyholder and ensures the policy is not misused from the insurer’s side.

Yes, the policyholder will have to settle the copay amount even for cashless hospitalization.

The benefits of copay depend on various factors like age, budget, location, network hospitals, healthcare requirements and coverage limitations. A policyholder must understand these factors before choosing a health care policy with copay.

20% of the co-payment in health insurance means that at the time of Hospital bill payment, 20% of the total bill will be paid by the insured i.e [Medical bill amount] x 20%, while the remaining cost is paid by the insurer as per policy conditions.

People prefer health insurance plans without a copay clause because it allows the policyholder to predict healthcare expenses and prevents any large out-of-pocket expense. Moreover, it is more convenient for the policyholder to raise a claim and let the insurer handle the rest.

Related Articles

Preventive Health Check-up 80D: How to Save Tax While Staying Healthy

February 9, 2026

10 min 50 sec read

Impact of Room Rent Capping on Health Insurance Claims: What Most Policyholders Miss

September 14, 2025

4min 5sec read

National Insurance Awareness Day – 28th June

June 28, 2025

4 min 32 sec read

The Essential Guide to Types of General Insurance: Protecting What Matters Most

July 28, 2025

8 min 50 sec read

Understanding the Different Types of Health Insurance: A Comprehensive Guide

July 28, 2025

7 min 10 sec read

Comprehensive vs. Third-Party Car Insurance: What Should You Choose?

July 28, 2025

7 min read