February 9, 2026

10 min 50 sec read

Preventive Health Check-up 80D: How to Save Tax While Staying Healthy

Written by: Team Achha Kiya Insurance Liya

Summary

Section 80D of the Income Tax Act offers tax-saving opportunities when you prioritize your health through Preventive Health Check-ups. According to section 80D, a taxpayer can claim a tax deduction of up to ₹5,000 per financial year. This benefit can be availed for self, spouse, dependent children, and parents. :Preventive health check-ups can be paid in cash, but health insurance premiums cannot. Premiums must be paid through banking channels to be eligible for 80D deduction.

By opting for regular health screenings under Section 80D, you not only secure your wellbeing but also ensure financial security, making it a win-win approach!

Table of Contents

- Introduction

- What is a Preventive Health Check-up?

- Who Should Get Preventive Medical Check-ups?

- Preventive Health Check-up Limit Under Section 80D

- Payment Mode Rules of Preventive Health Check-ups

- Can You Claim This Without Having Health Insurance?

- What are the documents required as Preventive Health Check-up proof?

- Common Mistakes to Avoid

- Conclusion

Introduction

Prevention is better than a cure.

This applies mainly to our health. Today, health issues have become unpredictable. People are getting diagnosed with diseases that they did not anticipate. In such situations, we regret having to take preventive measures.

As people are becoming more and more aware of their health, preventive health check-ups are gaining significant importance. It benefits people through early detection and preventive care. With tax benefits for preventive health check-ups, it encourages people to take preventive measures.

What is a Preventive Health Check-up?

Preventive health checkups help maintain good health. They aid in detecting potential ailments early, before they become severe. They involve several medical tests and screenings that can diagnose diseases or illnesses. They are significant for one’s health as most health issues like diabetes and heart issues may not have noticeable symptoms. Without timely detection, they can grow into severe conditions.

Early detection enables timely care and reduces the financial burden associated with treating advanced-stage diseases.

Who Should Get Preventive Medical Check-ups?

Preventive health check-up is an essential precaution for one’s health to detect potential health issues early. These plans are available for all age groups. However, they are particularly important for those above 30 or with high-stress lifestyles. This is the age when health issues like diabetes, hypertension, and heart issues typically begin. Moreover, all those who fear that their lifestyle may lead to certain health issues should get preventive health check-ups annually.

Preventive Health Check-up Limit Under Section 80D

The cost of preventive health check-ups can discourage people from availing one. However, under section 80D of the Income Tax Act, preventive health check-ups come with tax benefits.

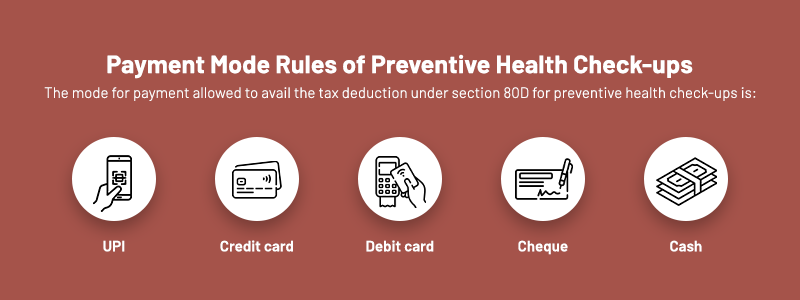

Payment Mode Rules of Preventive Health Check-ups

The mode for payment allowed to avail the tax deduction under section 80D for preventive health check-ups is:

- UPI

- Credit card

- Debit card

- cheque

- Cash

Can You Claim This Without Having Health Insurance?

A common question among taxpayers is “whether health insurance is mandatory for claiming this benefit?”

No, even if you do not have health insurance, you can still claim the tax deduction of ₹ 5000 for your preventive health check-ups done in a financial year.

What are the documents required as Preventive Health Check-up proof?

There are no specified documents to submit as proof to make a claim for preventive health check-ups under Section 80D. However, to be on a safe side, one should keep the following ready for this tax deduction:

- Receipts or bills: A well-documented bill stating the number of tests done and the total amount paid, along with the diagnostic centre/hospital name, date, tests conducted, amount paid and contact information of the insurance provider.

- Health check-up report: For supplementary proof, you can also use the Health Check-up report shared by the diagnostic center.

Common Mistakes to Avoid

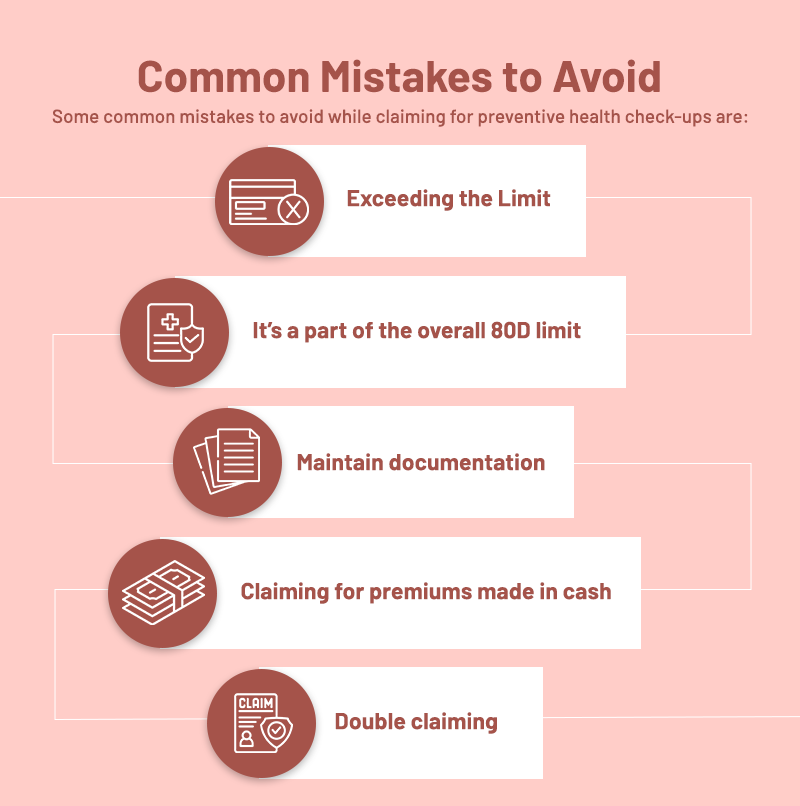

Some common mistakes to avoid while claiming for preventive health check-ups are:

- Exceeding the Limit: The per-year limit for preventive health check-ups under 80D is ₹ 5000. This limit is for the entire family, so if you get a Health Check-up done for your family, including spouse, children, and parents, you’ll have to cover the rest from your pocket.

- It’s a part of the overall 80D limit: The claim for preventive health check-up under 80D is a part of the total tax deduction limit on your health insurance. Since the ₹5,000 preventive health check-up limit is part of the total Section 80D limit (₹25,000 for non-senior citizens and ₹50,000 for senior citizens), you can claim it only within the overall cap.

- Maintain documentation: While it is not required, keep the invoices and bills handy while filing the claim.

- Claiming for premiums made in cash: You can pay for health check-ups in cash and still claim the benefit. However, insurance premiums paid in cash are not eligible.

- Double claiming: You cannot claim both the health insurance premium and medical expenditure for the same family member in the same financial year. However, you can claim health insurance premium and a preventive health check-up for the same person within the overall Section 80D limit.

- ✓ Allowed: ₹20,000 insurance premium + ₹5,000 preventive check-up = ₹25,000 total claim

- ✗ Not allowed: ₹20,000 insurance premium + ₹10,000 medical bills for the same person

For example:

Conclusion

Related Articles

What Is A Copay In Health Insurance? A Comprehensive Guide To Copay Benefits And How It Works

October 23, 2025

10 min 50 sec read

Impact of Room Rent Capping on Health Insurance Claims: What Most Policyholders Miss

September 14, 2025

4min 5sec read

National Insurance Awareness Day – 28th June

June 28, 2025

4 min 32 sec read

The Essential Guide to Types of General Insurance: Protecting What Matters Most

July 28, 2025

8 min 50 sec read

Understanding the Different Types of Health Insurance: A Comprehensive Guide

July 28, 2025

7 min 10 sec read

Comprehensive vs. Third-Party Car Insurance: What Should You Choose?

July 28, 2025

7 min read