September 14, 2025

4min 5sec read

Impact of Room Rent Capping on Health Insurance Claims: What Most Policyholders Miss

Written by: Team Achha Kiya Insurance Liya

Summary

Room rent limit in health insurance refers to the cap set by insurers on daily hospital room charges. If the policyholder opts for a room higher than the allowed room rent, they will have to pay the difference based on proportionate deductions. While room rent capping keeps premiums low, it can increase the amount you pay from your pocket. Some policies offer no capping on room rent. Such policies have a higher premium but benefit policyholders in choosing the hospital and room of their choice along with ensuring full coverage and a worry-free recovery.

Table of Contents

- Introduction

- What is Room Rent Capping in Health Insurance?

- How Room Rent Capping Affects Your Total Hospital Bill

- Different Types of Room Rent Limits in Health Insurance

- What is the Impact of Room Rent Limit on Health Insurance Coverage

- What Is ‘No Room Rent Capping’ and its Benefits

- Tips to Handle Health Insurance Policies with Room Rent Capping

- Conclusion

Introduction

Room rent, one of the essential items of hospital bills, significantly impacts the total cost of hospitalization. The charges for a room vary across hospitals and depend on the type of treatment and room selected for the patient.

Typically, health insurance policies have a room rent limit, which means a fixed portion of the total room rent that the insurer covers. The difference is covered by the policyholder.

Policyholders must understand what room rent capping is, how it works, and how it impacts claims. Read on to learn how room rent capping affects medical expenses and the role of your insurer to avoid any surprise costs during claims.

What is Room Rent Capping in Health Insurance?

Room rent refers to the daily cost of staying in the hospital. It is based on hospital location, room type, and the amenities chosen, like nurse servicing, meals, and other utilities provided. Together, these add up to the final room rent for the total number of days the patient stays in the room.

A room rent cap is the maximum amount your insurer will pay per day for a hospital room. If the room costs more, the policyholder will need to pay the difference out of pocket.

Is Room Rent Capping Always Applied?

No, room rent capping is not always applied but depends on the insurance provider. Some policies offer a no-room rent cap option. Such policies have higher premiums; however, they prevent large out-of-pocket costs.

Some health insurance policies may not apply room rent limits for the following situations:

- Admission to the Intensive Care Unit (ICU)

- Case of emergency hospitalization

- For treatment of critical illnesses like cancer and heart attacks.2

Note: Check with your insurer, while some waivers or ICU exceptions exist, they’re policy-specific.

How to check the Room Rent Limit?3

To check the room rent limit, do the following:

- Check your policy documents along with the terms and conditions and policy brochure provided by the insurer.

- Look for the section that explains hospitalization benefits or inpatient care.

- This section mentions room rent, including fixed amount, percentage of the limit, type of room, etc.

If the documents are unclear, contact your insurance provider and ask for these details in writing. You can also look for this information on their official portal.

How Room Rent Capping Affects Your Total Hospital Bill

Let’s understand the working of room rent limit during hospitalization with an example:

- Sum insured: ₹5 Lakhs

- Room rent cap: 1% = ₹5000 per day

- Hospital stay: 5 days

- Rent for the chosen room: ₹7000 per day

The ideal assumption about the amount required to be paid out of pocket will be ₹2000 per day (₹7000 – ₹5000).

However, if the policyholder chooses a room with a higher cost, let’s say ₹8000 (₹3,000 more than the cap), they will have to bear the difference based on “Proportionate deductions”.

Based on the room selected, many related expenses also increase proportionately leading to the need for deductions.

What are Proportionate deductions in Health Insurance?

Proportionate deductions in Health Insurance means that if the room rent exceeds the policy limits, all associated hospital charges, including doctor visits, medicines, treatment costs, etc., will also be proportionately reduced. Since many hospital expenses are linked to the type of room chosen, opting for a room beyond the eligible limit increases costs such as doctor’s fees, medicines, and treatment charges. As a result, insurers apply proportionate deductions to align these expenses with the room rent limit under the policy.

This is a key point that policyholders often overlook.

If the room rent limit is ₹5,000 but the policyholder chooses a ₹7,000 room, they won’t just pay the ₹2,000 difference but also get less coverage for the rest of their hospital bill.

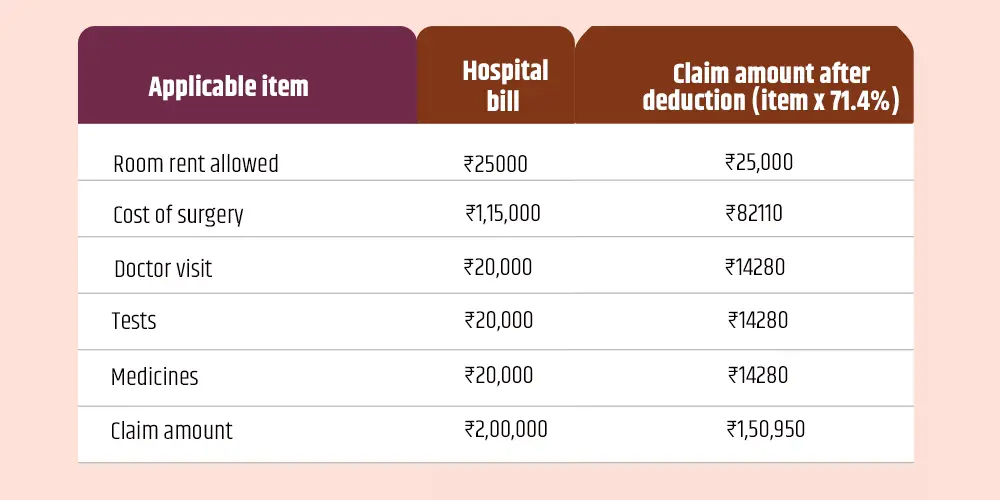

Proportionate deduction = Room Rent Allowed / Actual Room Rent x 100.

In this case= ₹5000 / ₹7000 x 100 = 71.4%

The percentage difference between allowed room rent and actual room rent is 71.4%.

This means 71.4% of the bill is eligible for the claim.

According to the calculations, the policyholder will have to pay approximately ₹49,050 out of pocket.

Note: The above costs are for reference purposes only and may differ from one hospital to another and from one city to another.

Different Types of Room Rent Limits in Health Insurance

Some types of room rent limits in health insurance provided by insurers are:

- No capping on room rent: Some policies offer full coverage of room rent allowing you to choose any type of hospital room.

- Co-payment on room rent: A copay on room rent means that the total expense of the hospital stay will be shared between the insurer and the policyholder. Insurers also put a copay if a room of higher rent than allowed is chosen by the insured.

- Room rent with capping: It refers to a limit placed on the cost of a room. The insurer pays up to the limit/cap and the difference is covered by the policyholder.

- Room rent on the specific room type: Certain policies only allow specific room types (e.g. AC rooms, Double-shared rooms, etc.). As the policyholder selects the room based on requirement and availability, it is on them to choose a room with a cap or a room without any cap.

- Room rent waiver add-on: An add-on option that removes any limit on room rent. While it increases the premium, it avoids hefty out-of-pocket expenses, especially in metros.

What is the Impact of Room Rent Limit on Health Insurance Coverage

Policies with a room rent limit in health insurance may work differently, which policyholders should understand to stay prepared4.

- Coverage Limits: Room rent capping reduces the coverage of the policyholder. For full coverage, they will need to choose a room that stays within the room rent limit.

- Impact on Claim Amount: If the policyholder chooses a room higher than the specified limit, they will have to pay the difference of not just the room but also other related expenses like doctor visits and medicines.

- Types of Rooms: Policies with a room rent cap often categorize the limit based on the room type (e.g., general ward, semi-private, private).

- Cashless Facility: Cashless claims provided by the hospital are subject to a room rent cap.

- Pre-Authorisation: If you are considering a room with higher rent, you may be required to get it pre-approved by the insurer.

What Is ‘No Room Rent Capping’ and its Benefits

No capping on room rent means that the insurer will not place any limitations on the room rent coverage provided it stays within the sum insured.

It lets patients choose any room. This is especially helpful for private or ICU rooms, which usually cost more. This keeps policyholders relaxed during the course of their treatment.

Some benefits of no room rent capping are:

- Choice of hospital rooms: It allows you to choose any room (twin-sharing, private or even deluxe private room) as per the requirement and the availability based on the sum assured.

- Quality treatment and stay: A well-equipped room with better amenities ensures that you get dedicated care, attention, and peace of mind during recovery.

- No deductions: Since proportionate deduction doesn’t apply, you get full claim coverage for treatments, tests, and surgeries. This helps you avoid out-of-pocket costs caused due to higher room rent.

Tips to Handle Health Insurance Policies with Room Rent Capping

If your health insurance policy has a room rent cap clause, here are some smart steps you should take before getting hospitalized:5

- Understand the limits: Go through your policy documents carefully to know the exact room rent limit covered under your plan.

- Choose hospitals and rooms wisely: Choose a hospital and room that falls within your allowed room rent to avoid paying extra.

- Purchase a room rent waiver: if your policy does not have a room rent waiver feature, consider purchasing one.

- Explore plans without room rent caps: While buying a new policy, look for one that has no room rent limit. It may come at a slightly higher premium but ensures complete financial protection during hospital stays.

Conclusion

- 1 https://www.manipalcigna.com/blog/room-rent-capping-in-health-insurance#:~:text=Room%20rent%20capping%20in%20health%20insurance%20is%20a%20limit%20set,of%20the%20total%20insured%20sum.

- 2 https://www.insurancesamadhan.com/blog/how-does-room-rent-capping-affect-the-final-billing/#If_Youve_Already_Faced_Deductions

- 3 https://www.manipalcigna.com/blog/room-rent-capping-in-health-insurance#:~:text=Room%20rent%20capping%20in%20health%20insurance%20is%20a%20limit%20set,of%20the%20total%20insured%20sum.

- 4 https://www.manipalcigna.com/blog/room-rent-capping-in-health-insurance#:~:text=Room%20rent%20capping%20in%20health%20insurance%20is%20a%20limit%20set,of%20the%20total%20insured%20sum

- 5 https://www.acko.com/health-insurance/room-rent-limit/

Related Articles

Preventive Health Check-up 80D: How to Save Tax While Staying Healthy

February 9, 2026

10 min 50 sec read

What Is A Copay In Health Insurance? A Comprehensive Guide To Copay Benefits And How It Works

October 23, 2025

10 min 50 sec read

National Insurance Awareness Day – 28th June

June 28, 2025

4 min 32 sec read

The Essential Guide to Types of General Insurance: Protecting What Matters Most

July 28, 2025

8 min 50 sec read

Understanding the Different Types of Health Insurance: A Comprehensive Guide

July 28, 2025

7 min 10 sec read

Comprehensive vs. Third-Party Car Insurance: What Should You Choose?

July 28, 2025

7 min read