July 28, 2025

7 min 10 sec read

Understanding the Different Types of Health Insurance: A Comprehensive Guide

Written by: Team Achha Kiya Insurance Liya

Summary

Health Insurance is an agreement between the insurer and the insured. The insurance company provides financial support to the policyholder during a medical emergency in exchange for a premium. There are different types of health insurance policies which can be purchased individually or as an add-on. The most common ones include Individual Health Insurance, Family Floater Plan, Group Health Insurance, and Senior Citizens Health Insurance. The policyholders must understand their healthcare requirements and purchase a policy that provides them with maximum coverage.

Table of Contents

What is Health Insurance

Health insurance is a policy that provides financial coverage for medical expenses incurred by the insured. It covers hospitalization costs including surgeries, doctor consultation, pathology, radiology, chemotherapy, dialysis expenses and pre and post hospitalization charges for related health conditions. Moreover, critical illnesses health insurance policies may also provide a lump sum to support the patient in time of critical illness as defined under the policy.

Read about different types of health insurance available to choose the one which aligns with your healthcare needs.

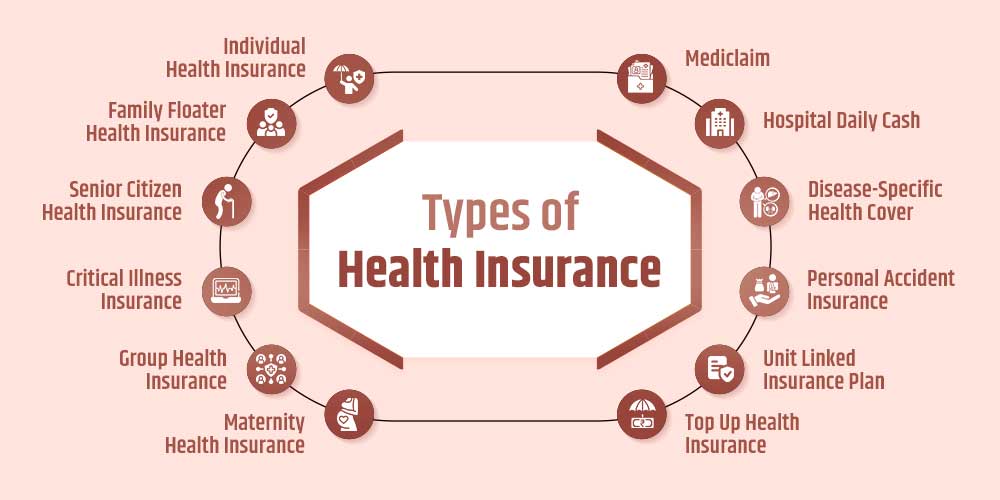

Types of Health Insurance and Their Features

Understanding the various types of health insurance available can help individuals choose a plan that best suits their needs1:

- Individual Health Insurance: This is a plan which covers only one individual and provides them with medical coverage when needed. This option is for those who want their in-patient expenses covered. It provides coverage for hospital stays, surgeries, or other medical treatments related to accidents, illnesses, or any medical emergencies.

It is suitable for any individual without any dependants. - Family Floater Health Insurance: Unlike an individual plan, a family floater plan covers all family members against expenses as mentioned in the point above. It is more convenient and cost-effective.

It is suitable for the entire family, including children and parents. - Senior Citizen Health Insurance: Made for senior citizens, this health insurance addresses coverage as per policy terms and conditions. Some of the Senior citizen plans are comprehensive plans covering physiotherapy expenses, OPD coverage, etc. in addition to the hospitalization charges.

It is suitable for citizens above the age of 60. - Critical Illness Insurance: This policy provides a lump sum amount upon diagnosis of specific fatal diseases such as cancer, heart attack, or stroke, etc. as per policy terms.

- Group Health Insurance: This health insurance policy covers a group of individuals. Often purchased by employers for their employees, this provides basic coverage and sometimes can extend to dependants like family members as well.

It is suitable for company employees. - Health Insurance with Maternity Cover: Covers expenses related to childbirth, prenatal, and postnatal care, making it beneficial for expecting parents, as per policy terms and conditions. This insurance takes time to activate, so it should be taken early in the planning phase of starting a family. It can be purchased as an add-on with the individual health insurance policy or a family floater plan depending on the offering by the Insurance Company.

- Hospital Daily Cash: This policy provides a daily hospital allowance subject to a limit, to help cover out-of-pocket hospital expenses. This add-on policy is beneficial as health insurance does not reimburse for incidental expenses like food, etc.

- Disease-Specific Health Cover: Targets specific illnesses like COVID-19 (Corona Kavatch), vector borne diseases, etc.

It is suitable for people who are at risk of developing specific diseases, especially in locations which are prone to spread such diseases. - Personal Accident Insurance: Accident is the most uncertain event and one needs protection financially to bear the expenses. This plan offers financial assistance in the event of an accident which results in partial disability, total disability, hospitalization expenses arising out of accidents and death of the policyholder.

- Top Up Health Insurance: This plan can be purchased when the individual or family wishes for additional coverage. It can be bought over and above their primary policy to cover expenses incurred when their primary sum insured is exhausted.

Who Should Consider Buying Health Insurance and When?

Every individual is vulnerable to health challenges. As people grow older, the chances of developing health issues only increases. In such cases, it is crucial to invest in a health insurance policy. With a diverse range of health insurance plans, there is something for everyone— from young individuals and senior citizens to those with a history of critical illnesses.

It’s advisable to purchase health insurance early in life to avoid higher premiums and waiting periods associated with pre-existing conditions.

Why Should You Buy Health Insurance?

Health insurance is not just a preventive measure– it also provides a financial safety net when needed. Here are some reasons why you should buy a health insurance:2

- Financial Protection: Health insurance shields individuals from the financial burden of medical treatments, ensuring savings remain intact.

- Combats Rising Inflation: With rising inflation, it will become even more difficult to pay hefty medical bills in future. To manage rising medical expenses coupled with inflation, it is a smart decision to be covered with a health insurance policy.

- Tax Benefits: Under section 80D, deduction can be claimed on medical insurance premium paid by the taxpayer up to Rs. 1 lakh. Deduction can be claimed for self, spouse, dependent children and parents. Up to Rs. 25,000 of insurance premium paid can be claimed for the self, and a deduction of Rs. 50,000 can be claimed for self, spouse, children and parents put together.

- Peace of Mind: Medical expenses can end up costing you your entire life’s savings in times of critical illnesses. Therefore, purchasing health insurance can allow people to heave a sigh of relief even in times of distress.

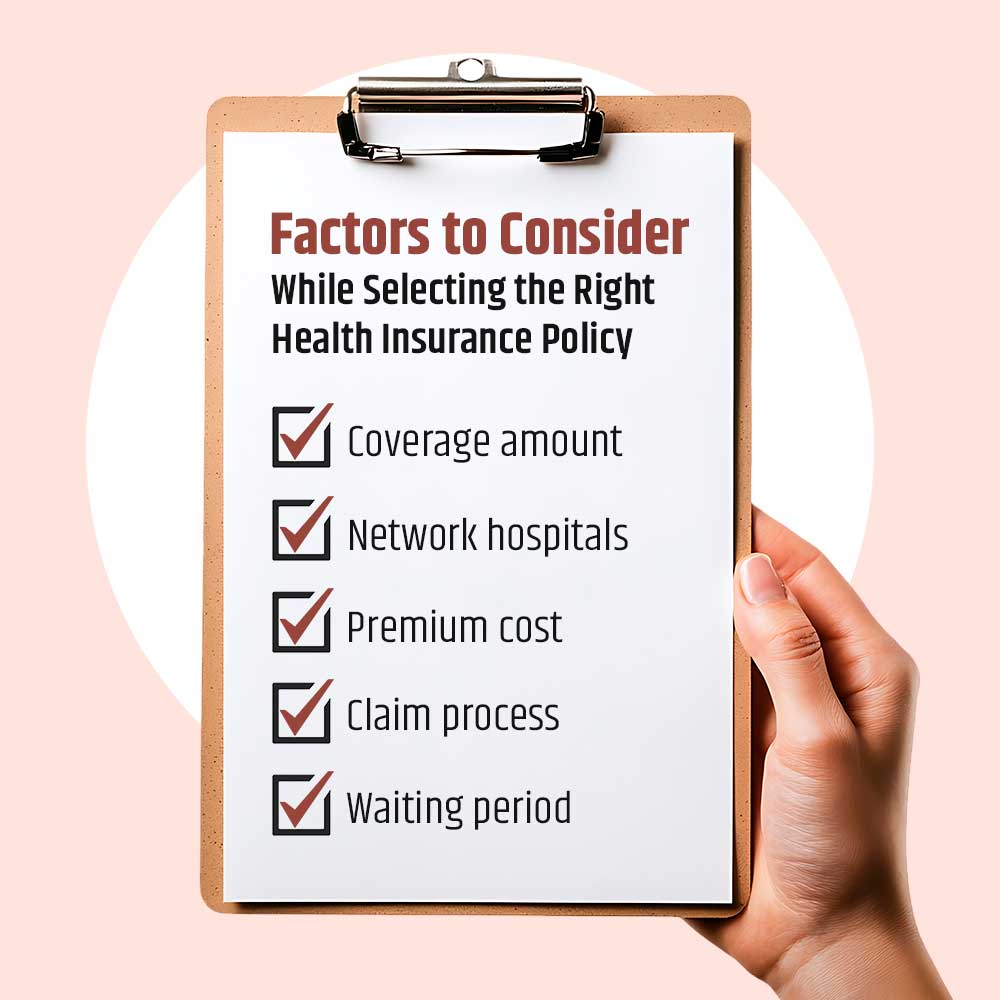

Factors to Consider While Selecting the Right Health Insurance Policy

There are several factors to consider before choosing a health insurance policy. These include age, health status, city of residence, as well as lifestyle. A coverage should be decided on these factors so that in the times of need, proper financial assistance can be provided.3

- Coverage Needs: Decide insurance coverage based on factors such as medical history, age, lifestyle and city of residence. If you are buying a policy for senior citizens, make sure the coverage amount is higher. On the other hand, when taking a family floater plan, choose a policy which addresses the concerns of each family member.

- Network Hospitals: Check the list of empaneled hospitals under your policy for cashless treatments. Ensure it includes your preferred hospital.

- Availability of add-ons: Compare various health insurances to check if the plan offers add-ons for extra protection.

- Limitations: Read the terms and conditions of various health insurance policies thoroughly to check for limitations and exclusions like sub limits, deductibles, co-payments, sum insured capping etc.

What does Health Insurance exclude?

- OPD Charges: Most health insurance policies don’t cover outpatient costs like doctor visits, medicines, or diagnostic tests, unless taken as an add-on.

- Dental & Eye Checkups: Routine dental and eye exams are excluded from basic coverage.

- Adventure Sports Injuries: Injuries from adventure activities like trekking, paragliding, etc., are not covered by most policies.

- Self-inflicted Injuries: Injuries caused by self-harm are excluded.

- Cosmetic: Treatment for cosmetic purposes is not usually covered.

- Sexually Transmitted Diseases: Treatment for STDs or venereal diseases is not included.

- War-related Injuries: Any injury or death caused during war or war-like situations is excluded.

Conclusion

FAQs

Hospitalization benefits in health insurance typically cover patient treatment, room rent (subject to policy terms), doctor’s consultation charges, tests, medicines and consumables, ICU charges, and ambulance costs.

Pre and Post hospitalization expenses refer to consultations, investigations, medicines and other related expenses incurred for a specific period before hospitalization and after discharge in relation to treatment undergone in the hospital.

A waiting period in a health insurance policy means the period upto which the policy will not extend any benefits or pay for costs incurred against specific conditions or diseases including the pre-existing conditions specified in the policy. For instance, a 2 to 3 years waiting period is common for a pre-existing disease or condition.4

Yes, you can, based on the specified terms and conditions. While family floater plans cover multiple members under one sum insured, it’s advisable to have separate policies for parents, especially if they are senior citizens.

The ideal health insurance coverage depends on age, place of residence, pre-existing health conditions, family health history, and preferred hospital. However, these are the common factors:

- The insured sum depends on the cost that may be incurred. This can vary from ₹25000 to ₹5 Lakh or more depending on various contingencies.

- The coverage amount should cover for critical illnesses like Cancer, Stroke, cardiac conditions etc.

- The affordability of premiums also matters.

Ideally Health Insurance needs to be taken from the time a child is born since illness can affect at any age. As a teenager once you start earning, your 20s are the perfect time to purchase health insurance in India. It is advised to purchase it at an early age as it helps with the waiting period, no pre-policy health checkups, and lower premiums.5

Related Articles

What Is A Copay In Health Insurance? A Comprehensive Guide To Copay Benefits And How It Works

October 23, 2025

10 min 50 sec read

Impact of Room Rent Capping on Health Insurance Claims: What Most Policyholders Miss

September 14, 2025

4min 5sec read

National Insurance Awareness Day – 28th June

June 28, 2025

4 min 32 sec read

The Essential Guide to Types of General Insurance: Protecting What Matters Most

July 28, 2025

8 min 50 sec read

Comprehensive vs. Third-Party Car Insurance: What Should You Choose?

July 28, 2025

7 min read